Live sports remains one of the main things people tune into on TV, and Disney, which owns live sports staple ESPN, knows it. But the media conglomerate is willing to experiment with bringing live sports to internet-only streaming services.

The company announced on Tuesday that it was acquiring a 33 percent stake in BAMtech, a technology company spun off from digital media company MLB Advanced Media, for $1 billion. It will be paid in two installments, with the option to acquire majority ownership.The deal had been rumored for months.

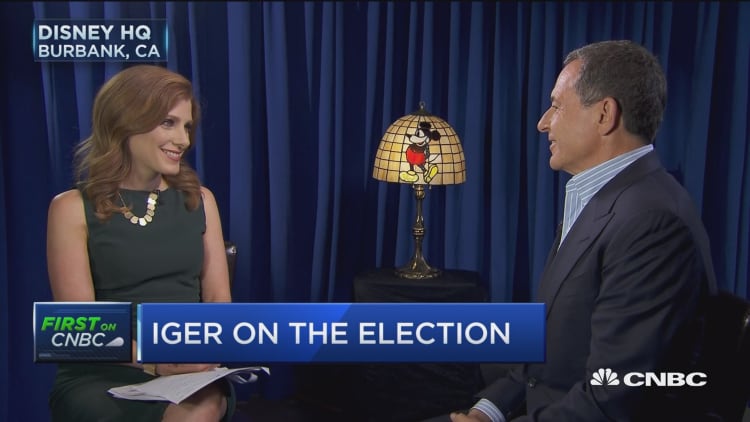

"We think it is a good investment," said Disney CEO Bob Iger on "Closing Bell." "We love the business model. We think that in today's world having the ability to stream on a scaled basis, live sports and live programming is a competitive advantage and something that is necessary."

BAMtech will work with ESPN to create a standalone, cable-free digital streaming service. However, the new product will not have current linear ESPN content.

The deal is independent of the upcoming DirecTV over-the-top (OTT) bundle. Disney announced on Tuesday that it will make ESPN, ESPN2, ABC, Freeform (previously known as ABC Family), Disney Channel, Disney XD and Disney Jr. available through the streaming service through different subscription packages.

On a call with analysts on Tuesday afternoon, Iger said that the pricing of the DirectTV OTT service would be similar to what consumers are used to on their traditional pay-TV services. ESPN's offering would have several options for viewers.

"By us being on these platforms at prices that make sense to us, we're really quite neutral in terms of shifting from a traditional MVPD (multi-video programming distributor) consumer to an over-the-top consumer," Iger said on the call.

"Technology has fundamentally changed the relationship that consumers have with television," said Mike Goodman, director of digital media strategies for Strategy Analytics. "It used to be dependent on appointment viewing, but across the board networks are coming to the realization that it's changing."

Disney, which reported earnings after Tuesday's closing bell, had adjusted earnings of 1.62 per share. Revenue for the fiscal 2016 third quarter was $14.277 billion.

Michael Morris, Guggenheim entertainment and media analyst, said on "Power Lunch," that distribution partners are finding digital ways to get to consumers, while viewers are tuning into other ESPN competitors like Fox Sports, CBS Sports and NBC Sports. Meanwhile, Disney is still reliant on ESPN revenue, which is often is the most expensive part of a cable package.

"Disney is a great company, but it's working through a couple of challenges," said Morris. "The biggest challenge is the fact that ESPN in our opinion overearned for a very long period of time."

What's especially interesting about MLBAM is that it powers over-the-top video services like HBO Now and The Blaze, which allow consumers to watch content without a cable subscription.

Strategy Analytics' Goodman pointed out that while Disney has a strong relationship with cable companies, going direct to consumers with a sports package allows them to get more revenue. Instead of having to cut a deal with cable companies and only take a portion of subscriber fees, Disney would get the full share.

"A standalone service does get to the issue of providing program flexibility, and it benefits [Disney] by going direct to consumer," said Goodman.

While cutting out cable companies could potentially anger them, Goodman points out that the profit margins are better on broadband than on cable. Since you need a steady Internet connection to stream the content, telecommunications companies will still get their share of the revenue.

However, Piper Jaffray research analyst Stan Meyers said on "Power Lunch" subscriber levels aren't shrinking fast enough to make creating an standalone ESPN service a necessity. He said the company only lost 1 percent of ESPN subscribers in Q1.

"Ninety percent of all live viewership is sports, so I think overall ESPN remains a critical component of TV consumption today," he said. "But I think Disney is slowly taking on digital platforms. It's layering in that new subscriber growth from those platforms, and starting to take on those digital platforms as well."

Disclosure: NBC Sports is owned by Comcast, the parent company of CNBC.

Correction: An earlier version of this story misstated the company Disney bought a stake in.